Based on Government Regulation PP 58 2023 and Ministry of Finance Regulation KMK 168 2023, the Indonesian government has simplified and changed the withholding tax for employees or the PPh 21 deduction.

Based on that regulation, companies should use the tariff effective rate, which depends on tax status (married or unmarried and number of dependents). With various tax statuses, there are 125 tariff effective rates. This tariff effective rate makes easier for taxpayers and the Tax office to check the calculation compliance. However, as the tax law is still the same, the company must recalculate the applicable tax rate based on annual income at the end of the year or if the employee resigns. So, the employee needs to be wise in spending income from January to November because the monthly tax deduction in December will be different, which can be less or more tax deductions. The new regulation also applies to individuals who are not employees, which means the withholding tax may be smaller than the previous tax regulation. So, the individuals may need to prepare a lack of tax payment at the annual income tax reporting.

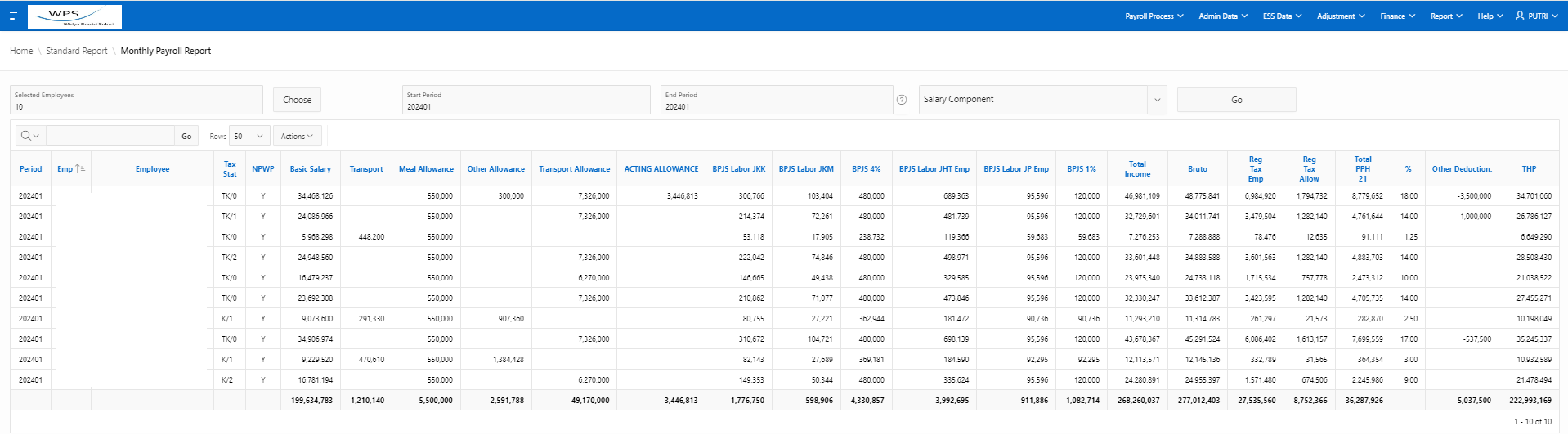

As Myquantumhr should comply with this regulation, this is the example of the monthly payroll report that the HR can recheck the tariff effective rate based on this regulation when the company use Myquantumhr as a payroll software.